About Me

Using data to discover the unknowns!

I work on breaking complicated business problems into

simple components and apply advanced analytics to generate actionable insights.

A graduate of the MS in Financial Technology & Analytics program

from University of Texas - Dallas.

I have undertaken projects in Dashboarding, Causal Analytics, Machine Learning,

Root Cause Analysis, Statistical Analysis, Credit Risk Analytics, Data Validation and Database Management.

Tools:

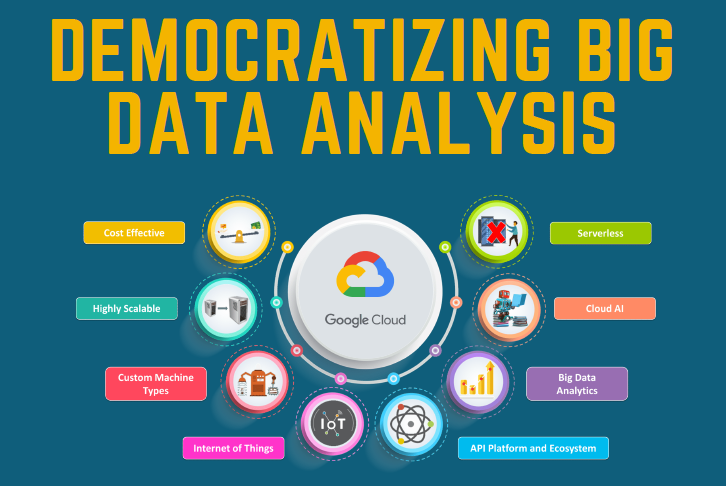

SQL, Python, Tableau, PowerBI, Excel, AWS, PowerPointTechniques:

Predictive Modeling, Exploratory Analysis, Statistical Analysis, Time Series Forecasting, A/B testing, Data Visualization, Big Data, Deployment Testing,Scrum & Agile methodologies, Credit Risk Modeling, Data Validation, Financial Modeling, Data Analysis